Personal Lines

Auto

Drive streamlined policy and claims lifecycle management for motorists

Speed implementation and provide robust lifecycle management from day one with an integration-ready personal auto solution that boasts out-of-the-box configurations and functionalities.

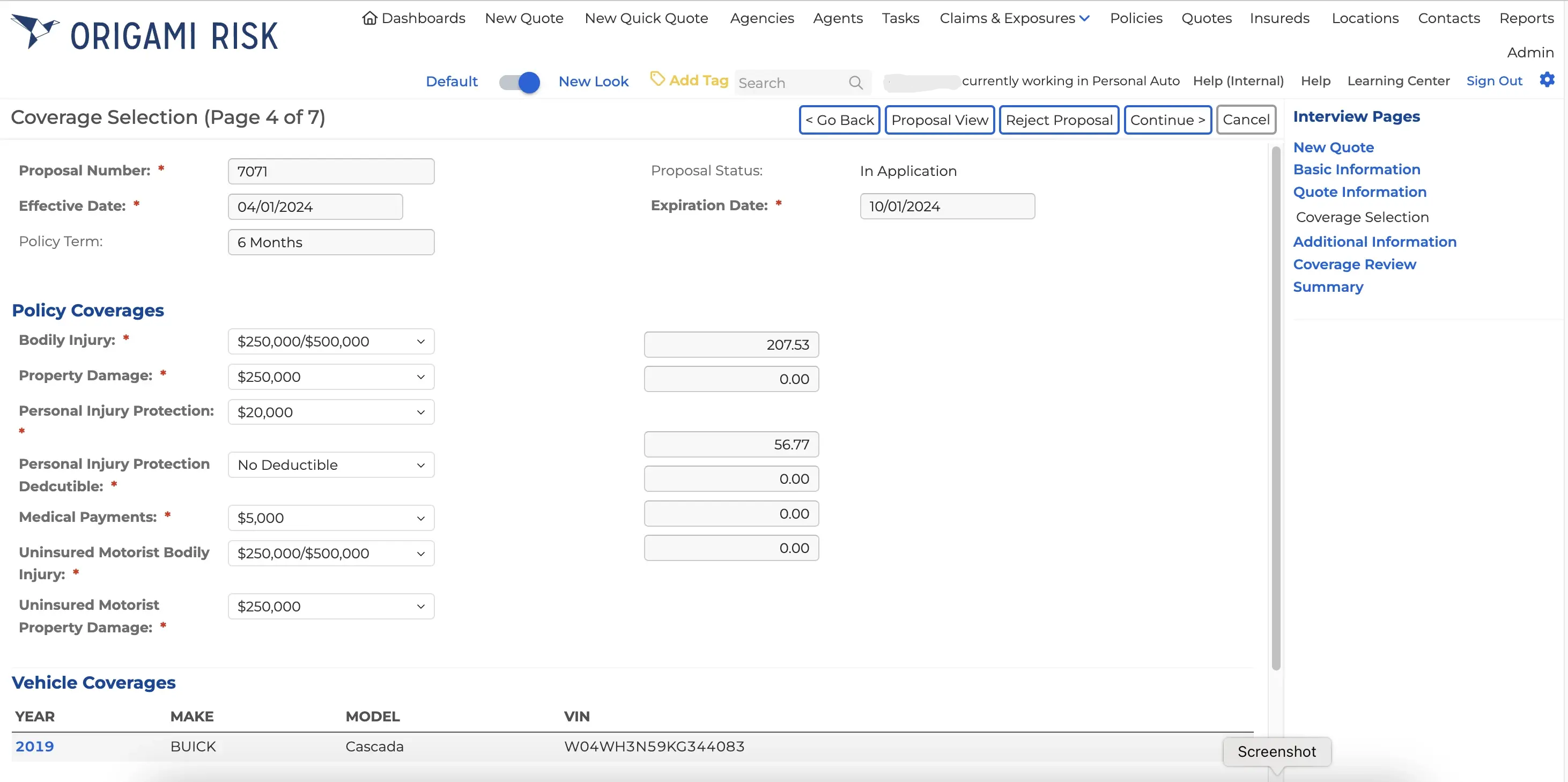

Policy Administration

Propel exceptional policy administration

Accelerate implementation

Leverage pre-built, post-issuance workflows for endorsements, renewals, cancellations, reinstatements, and rewrites.

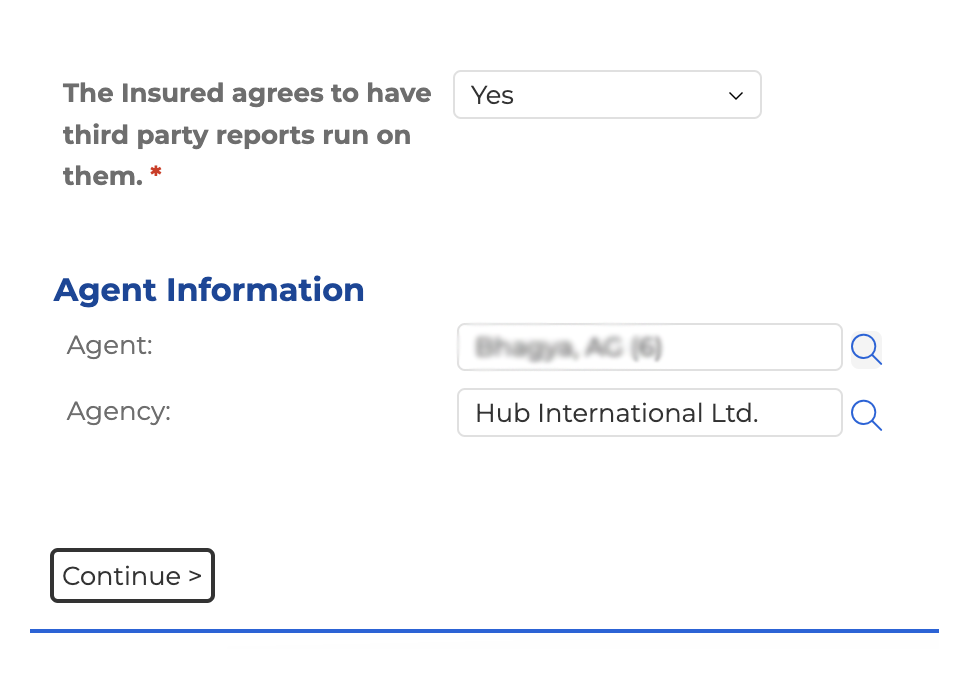

Configure to meet your business needs

Tailor auto specifications for rating, billing and commission, business and underwriting rules, and policy documents.

Simplify driver data management

Easily add new drivers to policies and vehicles, and manage driver information so it’s simpler to repurpose and requires fewer integration calls.

Foster positive customer experiences

Deliver straight-through policy processing and easy endorsement management.

Optimize through integrations

With our integration-ready platform, configure drivers and motor vehicle coverages, rules, rates, forms, and workflows to manage risk selection and ensure pricing adequacy.

Billing

Use billing touchpoints to drive customer satisfaction

Reward good driving behavior

Apply good student and safe driver discounts.

Make communication count

Proactively notify policyholders with payment and renewal reminders to avoid late payments and penalties.

Offer billing flexibility

Accommodate customer preferences and streamline operations with flexible billing options and automated invoicing.

Claims Administration

A claims experience to leave policyholders satisfied

Automation that gets more done

Streamline claim processing from start to finish with cloud technology that connects the insurance value chain, automates actions at every step so you never miss a beat, and helps handle the complex when it arises.

A firm handle on expenses

From loss reserving to repair completion, ensure that every step efficiently moves the claim forward with minimal leakage–with reporting to prove it.

Technology that supports stellar customer service

Help your staff deliver positive outcomes by providing personalized updates and communications that reassure policyholders and build satisfaction.

Explore how Origami helps you expertly manage end-to-end claims handling functions.

FNOL

Triage and assignment

Reserving

Investigation

Evaluation

Settlement and claim payment

Compliance

Subrogation and salvage

ebook

Selecting a New Core Platform?

Mitigate Risk with True Cloud SaaS

Selecting an insurance core platform can be challenging as buyers weigh available options. This guide helps insurers navigate the critical architecture in cloud platforms to jumpstart their digital transformation journey.

You’re always on the latest software version

Benefit from best-in-class security, proven dependability, and trouble-free updates with our superior multi-tenant SaaS platform.

Connect with essential ecosystem partners through hundreds of proven integration templates.

Accelerate speed-to-market with configuration over coding.

Avoid costly, IT-intensive development and ongoing maintenance.